From January to March 2020, the decline of initiatives and economic offers was clearly visible against the background of the situation in China, which is the largest exporter in the world. The first cases of infections in the EU were detected at the beginning of March, since that time the measures aimed at stopping the increase of infections have been there gradually introduced. With the implementation of restrictions and the increasing number of SARS-CoV-2 infected, every industry (more or less) prepared itself for the upcoming months, which were a great unknown.

At the beginning of the pandemic, when the situation in Europe started to dangerously and drastically develop, many carriers were refusing to carry out transports. Many companies were not physically prepared for the strict requirements introduced by the WHO. Those who decided to face the threat and continued operation, had to adapt the schedule of drivers and work conditions to the applicable guidelines. As a result of that, there was a drastic drop in capacity. One can say that the situation stabilised at the moment of closing production and factories in the 2nd quarter, when the balance of supply and demand was maintained. With the easing of quarantine measures and the elimination of restrictions, the economic activity was slowly recovering, however, the export growth stays at a quite low level. The carriers re-divided their transport assets which allow them to keep relatively decent rates until the 3rd quarter.

Currently, freight rates are going up. It is connected with the expectations of an increase in demand as well as with the decline of transport capacity during the period when restrictions are in force or are lifted. Further price dynamic for transport services depends directly on the power of demand because the supply is slowly rebuilding.

In April 2020, the forecasts of the World Trade Organisation announced that in the worst-case scenario, the decline in the global trade of goods would be between 13-32. A few months later, the experts announced that due to a proper response of some governments which supported their local economy, the reduction in the world trade won’t reach the critical level. Economists predict that international flows in the service sector will remain relatively low for a long time, and therefore a return to pre-pandemic levels could occur around 2023. Despite a decline in trade by around 15% for 2020, an increase of 8%is expected in 2021, followed by an improvement of 4.1% in 2022. Long-term forecasts for the transport industry are not optimistic. Many companies will fight to survive, others will disappear from the market.

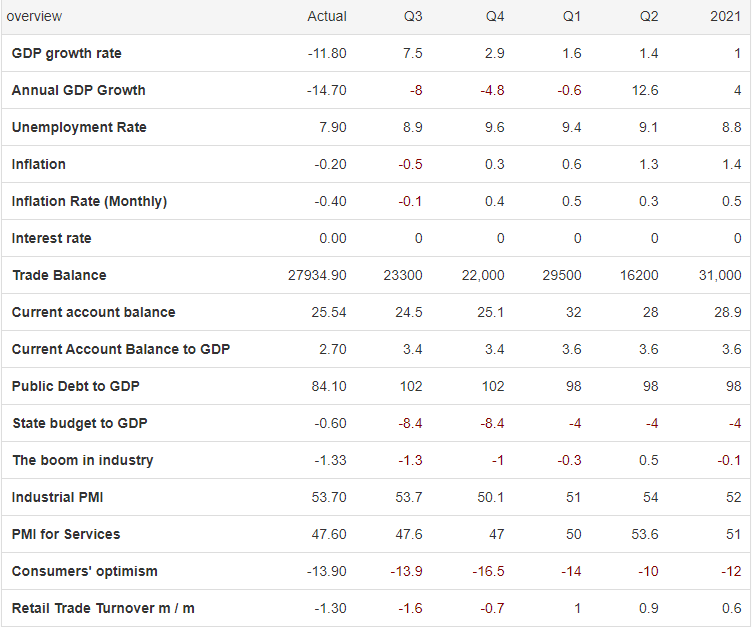

The table below presents significant forecasts of indicators for the Eurozone for the upcoming months.

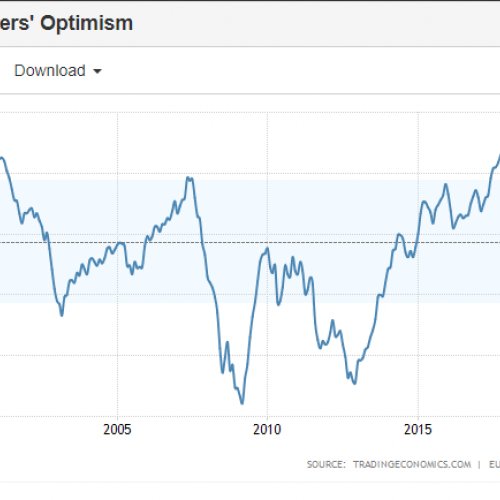

With even a little knowledge of the economy, you can see with the naked eye that the annual GDP growth is in the negative. It is encouraging that the PMI (Purchasing Managers Index) grows for both the service sector and the industrial sector (the indicator level exceeding 50 points means the growth of the industrial activity).